The government’s decision to delay the implementation of the Approved List of Models and Manufacturers for Solar Cells (ALMM-II) offers temporary relief to solar developers amid persistent domestic cell supply constraints. However, it also introduces fresh regulatory challenges, particularly around tariff renegotiations for recently awarded projects, according to analysts at CareEdge Ratings.

In a notification issued on July 28, 2025, the Ministry of New and Renewable Energy (MNRE) announced that all bids concluded before August 31, 2025, will be exempt from the mandatory use of domestically manufactured solar cells under ALMM-II.

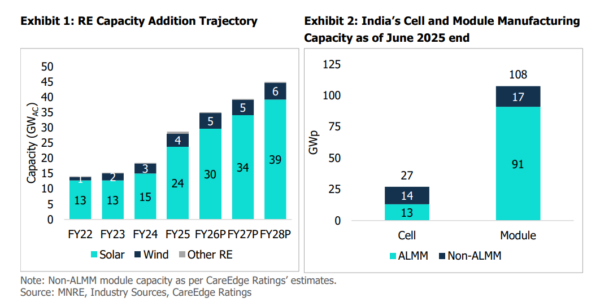

The move comes as India’s domestic solar cell production continues to lag significantly behind its module manufacturing capacity. As of June 2025, ALMM-I listed module capacity stood at 91 GWp, compared to just 13 GWp of ALMM-listed domestic cell capacity and 27 GWp of overall cell capacity (ALMM plus non-ALMM). The actual cell availability is even lower as a significant share of domestic cell output is exported, especially to the US.

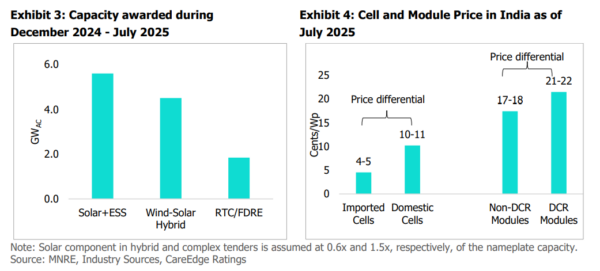

MNRE had originally notified the implementation of ALMM-II on December 9, 2024, mandating the use of domestically manufactured cells for all projects with bidding concluded after the date of notification. However, with the latest exemption, projects with bids concluded up to August 31, 2025—representing around 12 GWAC of capacity—can now use cheaper, imported solar cells.

According to CareEdge Ratings, this relaxation could lower solar project costs and thus reduce tariffs. Replacing DCR (domestic content requirement) modules with non-DCR modules may cut the capital cost for the solar component by around INR 0.45 crore per MWp. For a plain vanilla solar project, this could translate to a tariff reduction of INR 0.3–0.4 per kWh.

However, analysts warn that the revised ALMM-II timeline could create uncertainty for projects awarded between December 2024 and July 2025. Developers may have quoted higher tariffs in anticipation of having to use costlier domestic cells. With the latest exemption, developers may face tariff renegotiations, potential cancellations by ultimate offtakers, or regulatory hurdles in securing approval for the bid tariffs.

“The revision in the framework for the applicability of ALMM-II modules is likely to bring its own set of complications. While it ensures continuity in India’s renewable energy growth trajectory, which the limited availability of domestic cells could have jeopardised, the frequent policy shifts present a unique challenge for regulators and offtakers. Whether and how REIAs can enforce a reverse change-in-law interpretation remains uncertain and could mark a first for the industry,” stated Jatin Arya, Director, CareEdge Ratings. “Furthermore, if these bids come up before regulators for a downward tariff revision, the situation could become more complex, as developers may contend that they have already placed orders with domestic suppliers, and reversing these could result in material losses. Even if such projects move forward, they are likely to face prolonged regulatory scrutiny and an extended gestation period before resolution,” Arya added.

CareEdge Ratings notes that no timeline exemption has been extended to open access or net metering projects. Under the Dec. 9, 2024, notification, such projects were permitted to use non-ALMM-II cells only if commissioned before June 1, 2026. While utility-scale projects have benefited from a favourable relaxation, no similar relief has been granted for open access and net metering-oriented projects.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.