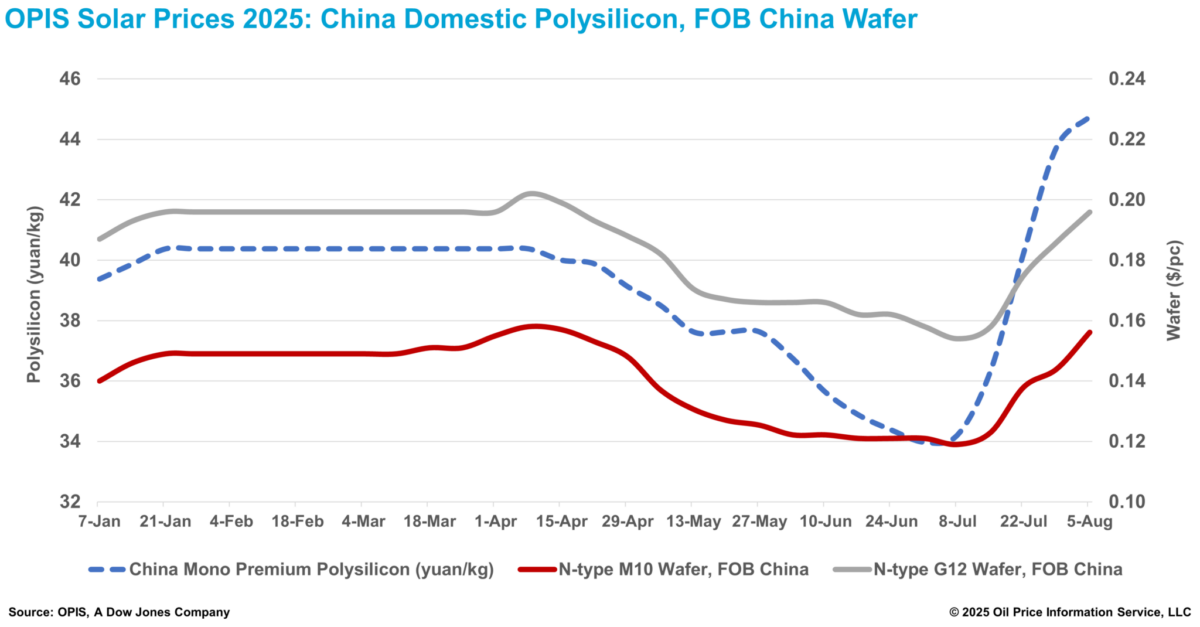

The China Mono Premium – OPIS’ assessment for mono-grade polysilicon used in n-type ingot production – increased by 2.29% week-on-week, reaching CNY 44.750 ($6.23)/kg, or CNY 0.094/W, according to OPIS Solar Weekly Report released on August 5. Similarly, downstream FOB China prices for n-type M10 and G12 wafers reached $0.156/pc and $0.196/pc, up by 8.33% and 5.38%, respectively.

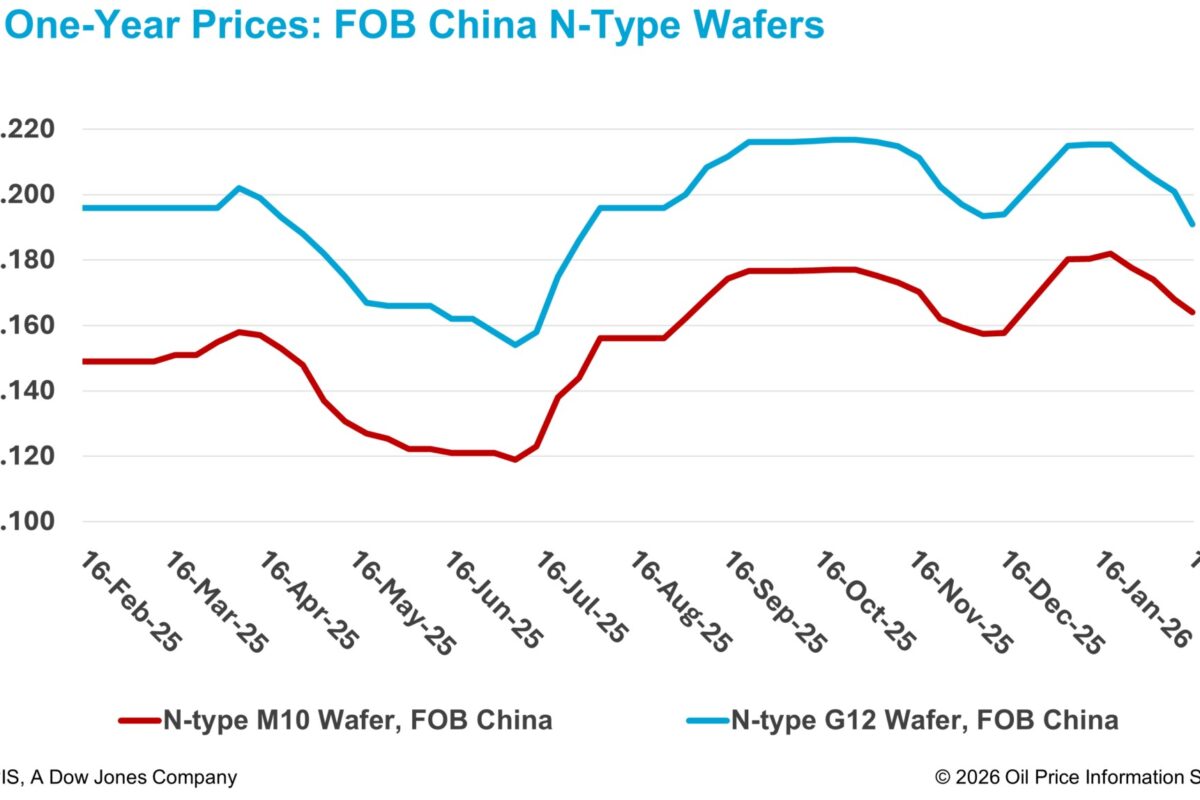

This week marks the fourth consecutive week of wafer price increases, with N-type 182mm wafers in the domestic Chinese market climbing from a recent low of approximately CNY 0.90/pc to CNY 1.21/pc. Market observers suggest that this upward trend may persist, as rising futures prices for polysilicon continue to drive increases in spot market prices.

The financial reality for most wafer producers remains challenging. Industry insiders revealed that current sales strategies adopted by silicon wafer manufacturers involve adjusting shipment prices in line with prevailing polysilicon purchase costs. This pricing strategy is intended to mitigate further financial losses as upstream raw material prices continue to rise. Although most wafer producers are reportedly maintaining gross profits, net profitability has not yet been achieved meaningfully, as manufacturers are squeezed between rising upstream polysilicon costs and persistent oversupply.

Meanwhile, rising prices are putting manufacturers in a strategic dilemma. While coordinated production restraint would offer market stability, the competitive advantage held by low-cost producers is already driving cautious capacity increases. According to a market observer, one manufacturer with cash costs for n-type M10 wafer around CNY 1.00/pc increased operating rates last week, while another leading producer raised utilization from around 50%. Insiders warn that if wafer prices continue rising in tandem with – or even outpace – polysilicon prices, the industry may see a reversal as the pricing environment could entice additional capacity to come back online

On the demand side, short-term export momentum may be supporting wafer price stability. A market participant reported that wafer exports are accelerating as downstream buyers seek to expedite procurement ahead of the U.S. Section 232 investigation into imported polysilicon and derivatives and the anti-dumping investigations targeting solar products from Indonesia, Laos, and India. However, market participants widely consider this demand surge temporary and limited in scale.

Demand from even the most promising export destinations, such as India and Turkey, remains constrained. Although wafer exports to these nations have grown steadily each quarter, India and Turkey each import approximately 1 GW of wafers from China per month, which is insufficient to support long-term price increases.

Looking ahead, the industry may soon face adjustments to export tax rebate policies, with the current 9% rebate potentially reduced or eliminated entirely. According to a market insider, while Chinese products are expected to retain a competitive edge globally due to their relatively lower costs, any resulting higher export prices would be absorbed by overseas buyers rather than improving domestic manufacturer profitability. The source explained that the essence of the policy shift is to limit the profit margins and arbitrage opportunities available to foreign importers rather than to benefit domestic producers directly.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.