India’s automobile industry could cut its manufacturing emissions by as much as 87% by 2050 through a shift to renewable power and low-carbon steel, according to a new independent study released today by the Council on Energy, Environment and Water (CEEW).

The CEEW study tracks emissions across three scopes: direct emissions from vehicle manufacturing (Scope 1), indirect emissions from electricity use (Scope 2), and upstream supply chain emissions (Scope 3). Scope 3 emissions currently make up over 83% of the auto industry’s emissions in India, largely due to the use of coal-intensive steel and rubber in vehicle manufacturing.

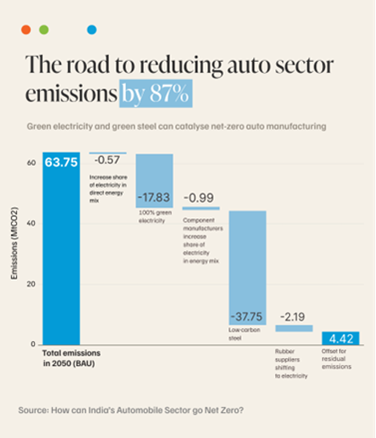

Using a custom version of the Global Change Analysis Model, the CEEW study projects that under the current business-as-usual (BAU) scenario, India’s annual vehicle production could rise nearly four-fold from 25 million units in 2020 to 96 million by 2050. Emissions, however, would only double, reaching 64 million tonnes of CO₂, suggesting a steady decline in emissions per vehicle.

Still, the absolute rise in emissions underscores the need for accelerated action. Steel alone would remain the largest source of supply chain emissions, with suppliers expected to rely heavily on coal in this business-as-usual scenario. The study estimates that sourcing low-carbon steel could reduce emissions by nearly 38 million tonnes by 2050.

If both OEMs and their suppliers were to aim for net-zero by 2050, annual emissions could fall to just 9 MtCO₂ from the projected 64 MtCO₂ (BAU) in business-as-usual scenario—an 87% reduction. This would require OEMs to shift to 100% green electricity—sourced through power purchase agreements (PPAs), renewable energy certificates (RECs), or captive solar—and steel suppliers to use 56% hydrogen-based energy, reducing coal’s share to under 10%.

In addition, increasing scrap-based steel production to 48% by 2050 would significantly reduce emissions and resource intensity. The CEEW study also highlights that rubber suppliers must transition to green electricity to clean up Scope 2 emissions.

The study estimates that annual electricity demand for auto OEMs will be around 195 PJ by 2050, approximately 54.17 TWh. If this demand were to be met entirely through solar energy, about 34 GW of solar capacity would be needed just to provide clean electricity for automakers.

Several leading automakers such as Mahindra & Mahindra, Tata Motors, TVS Motors, Ford, BMW, Mercedes-Benz, and Toyota have ramped up electric and hybrid vehicle production over the past two years while simultaneously setting ambitious emission reduction targets. These automakers have also committed to the Science-Based Targets initiative (SBTi), aligning with global definitions of net-zero that require full value-chain decarbonisation by 2050.

While many of these targets focus on direct factory emissions (Scope 1 and 2) and downstream use-phase emissions, upstream supply chain emissions remain largely overlooked, despite contributing the majority of the sector’s carbon footprint.

“India’s auto industry stands at a turning point. To lead in a low-carbon global economy, we must decarbonise not just the vehicles we drive but the industrial processes that build them. Automakers must clean up how their vehicles are made, what powers their factories, and how their suppliers produce critical inputs like steel and rubber,” said Dr Arunabha Ghosh, CEO, CEEW.

For large Indian auto manufacturers, cleaning up supply chains will not just lower emissions, it will enhance long-term cost competitiveness and position them as preferred international suppliers.

“Leading OEMs are already making corporate decisions to stay ahead by decarbonising their operations and supply chains. What’s needed now is strong procurement intent, especially through advanced market commitments to secure green steel and other low-carbon materials,” said Dr Vaibhav Chaturvedi, Senior Fellow, CEEW. “The policy landscape may be evolving, but major markets are still pushing hard on green through corporate and investor action. Indian automakers must treat clean manufacturing as a strategic lever—not just for cost control, but to stay competitive in global supply chains.”

To align the automobile sector with a 2050 net-zero pathway, the CEEW study recommends a two-pronged strategy: accelerate the transition to electric vehicles and decarbonise the full manufacturing value chain. Since 65–80% of a vehicle’s lifetime emissions come from its use phase, shifting to EVs remains the most effective way to cut end-use emissions. But deep reductions will only be possible if EVs are manufactured using clean energy and low-carbon materials. This requires coordinated action across OEMs and suppliers—supported by long-term procurement commitments and policy signals that encourage investments.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.