From pv magazine Germany

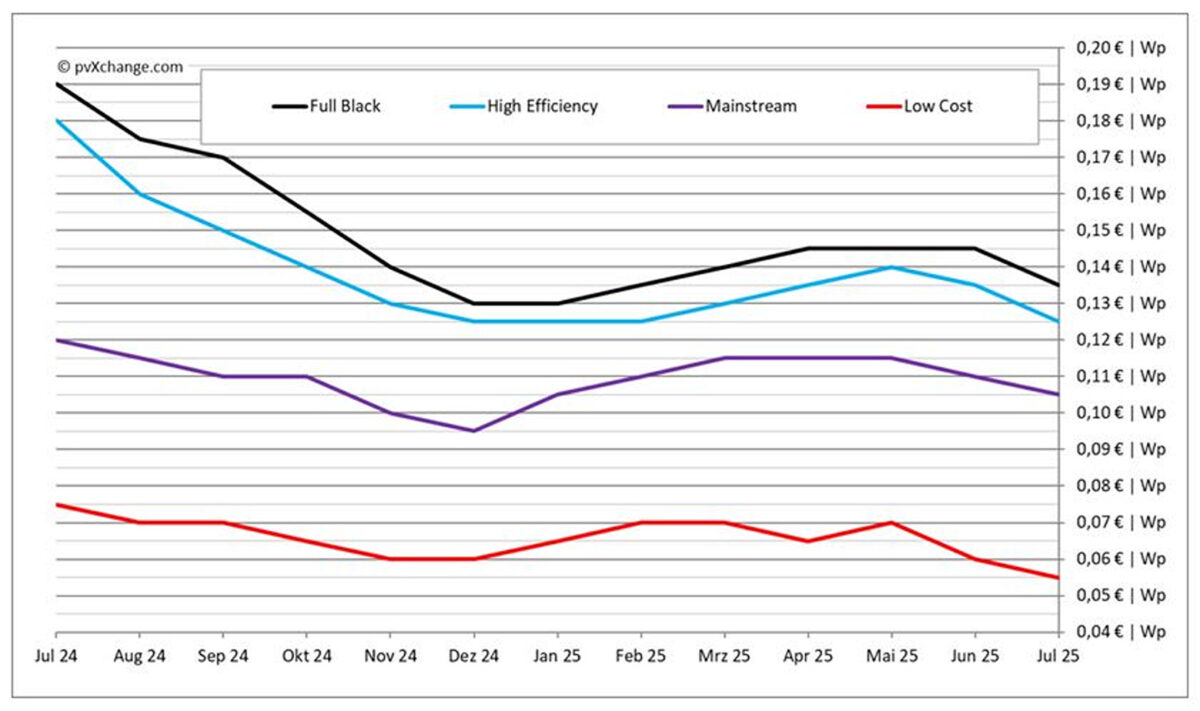

While the module market showed only marginal, unambitious movement in June, a clearer trend is now taking shape. Prices have begun to fall after a brief stabilization phase – declining by around 5% to 8% across all technology classes in recent weeks.

This drop returns prices to levels seen at the beginning of the year, a range that remains unprofitable for most module producers. Whether this is a temporary correction or the start of a sustained downward trend remains to be seen.

Some major wholesalers have already lowered prices by up to €0.02 ($0.023)/W after months of cautious increases. Others are expected to follow, as demand in the photovoltaic market continues to fall short of expectations. Excess inventory, purchased in anticipation of higher demand, is now weighing on balance sheets and must be cleared. The reductions are not solely borne by intermediaries, as falling silicon prices in China triggered the broader trend.

Domestic demand in China has weakened since subsidies expired, freeing up low-cost modules for export. Prices for bifacial glass-glass modules for utility-scale projects in Europe are again, or still, well below €0.10/W, delivered and installation-ready. That continues to strain manufacturers, many of whom have posted losses for two years and are now low on reserves.

Chinese manufacturers face added pressure as government support is phased out. Recent months have seen tax breaks removed and low-interest loans curtailed or recalled. With China’s goal of global solar market dominance largely achieved, its government expects companies to operate independently. Rescue packages and workforce transition plans are absent; companies face economic survival under harsh competitive conditions.

To counter these pressures, manufacturers are once again discussing price pacts, voluntary price floors, and production quotas to reduce internal competition and ease the price war. But previous attempts have shown limited success. In the end, each company along the supply chain acts independently – pushing every module it can build, regardless of margins.

Massive overproduction will persist in parts of the industry, especially as global demand softens amid political headwinds and a shift back toward fossil fuels. In the United States, a mix of protectionist trade measures and growing resistance to renewables is undermining demand, shutting out many foreign suppliers. Few alternative markets offer comparable pricing.

Expectations for a rebound in the European photovoltaic market in the second half of the year remain low. Policy resistance to solar and wind is rising, with climate goals slipping down political agendas. Recent statements by German Chancellor Friedrich Merz and Economics Minister Katherina Reiche underscore that trend.

Across the European Union, climate targets are being diluted, timelines delayed, and fossil and nuclear energy are reentering the mix. Even the relatively progressive European Commission is shifting rightward, making it harder to maintain ambitious renewable policies.

This instability discourages investment and weakens the outlook for new construction. Conflicting political signals are fueling uncertainty, while key grid and permitting reforms stall. Gains intended to accelerate the energy transition risk being reversed. Political actors appear more inclined to let the solar sector falter than to implement its cost-effective proposals.

In this environment, the industry must not retreat. Though another downturn may be coming, companies and advocates must continue to engage policymakers with clear arguments and evidence. Public engagement is also vital—citizens must take part in shaping a sustainable future. If necessary, that means renewed public demonstrations to demand a livable future.

Prices in June 2025, including changes from the previous month (as of July 7).

About the author: Martin Schachinger has studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he set up the pvXchange.com online trading platform. The company stocks standard components for new installations and solar modules and inverters that are no longer being produced.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.