The OPIS spot price for TOPCon ≥600 W modules DDP U.S. rose 0.38% this week to $0.264/W, on a limited number of price reports, with quotes for cargoes from Southeast Asia rising 0.39% to $0.257/W. Quotes for cargoes from India were stable week-over-week at $0.288/W. The spot price for Mono PERC modules ≤450 W EXW East Coast Warehouse (from distributors to installers) fell 0.63% to $0.318/W.

Quotes for US-assembled modules with imported cells continue to be heard between $0.26 and $0.33, while modules with domestic content – which are still limited to just a handful of producers – are generally quoted between $0.40/W and $0.50/W.

With the steep ‘reciprocal’ tariffs set to come online on July 9, a module broker shared that the bump from the new rates will be at least $0.05/W to $0.06/W. The broker has a customer taking two deliveries of utility-scale modules from Indonesia, 32 MW and 34 MW, in September and October at $0.27/W. That price would be in the low 20s without the reciprocal tariff factored in, he said.

The U.S. House of Representatives on Thursday passed its reconciliation “megabill” that will overturn the current renewable energy tax incentive landscape established in 2022 by the Inflation Reduction Act. The bill now goes to President Trump for his signature, ahead of GOP leadership’s self-imposed July 4 deadline.

Abigail Ross Hopper, President and CEO of the Solar Energy Industries Association (SEIA), said in a statement that the bill will halt the “industrial revival rural America needs and [hand] an untimely and strategic victory to China”.

The final version awaiting the President’s signature significantly pulls forward the phase-out schedule for the Clean Electricity Investment Credit (48E, or ITC), which otherwise would not have begun to lose value until next decade. This will, in turn, phase out the domestic content bonus, which created demand for modules and cells made in the U.S..

Developers who start construction before one year from this bill’s enactment – or sometime in July 2026 – will have four years to place their projects in service and receive the full value of the ITC. Otherwise, only projects placed in service before the end of 2027 will be eligible. The same schedule will apply to the Clean Energy Production Credit (45Y, or PTC).

The so-called ‘Residential ITC’ (25D) is teed up to phase out completely at the end of 2025, but the Advanced Manufacturing Production Credit (45X) retains a favorable phase-out schedule, losing 25% of its value annually starting in 2031.

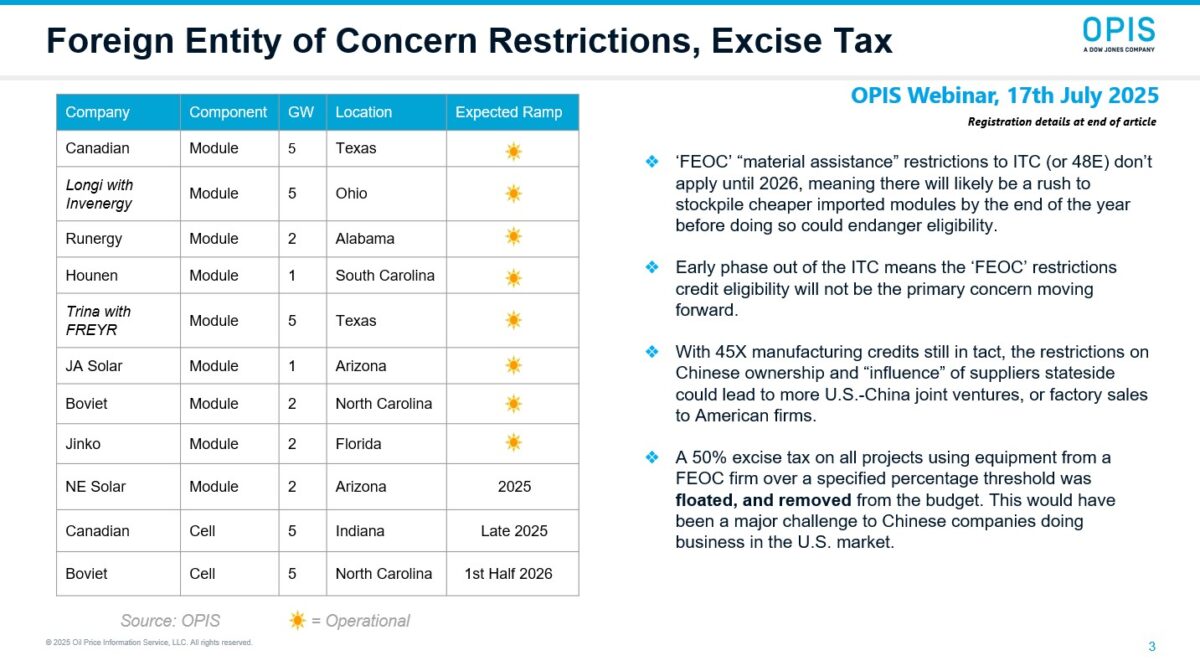

New “foreign entities of concern” (FEOC) restrictions will also complicate the path forward for U.S. solar. Though solar companies in the U.S. import very little directly from China owing to multiple rounds of steep tariffs, firms with Chinese ownership dominate the global solar supply chain, and have significant investment in American factories.

Any project that starts construction after 2025 will not be able to secure 48E if they utilize “material assistance” from a “prohibited foreign entity” (PFE) above a certain allowable percentage threshold. The same will apply to 45Y (PTC). And no factory owned by a PFE, or receiving material assistance from one, will be eligible for 45X manufacturing credits starting next year.

On Jul. 17th, 2025, OPIS will present on Beyond the Tariff Stalemate: Finding Solar’s Next Market Phase. Register here.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.