Ensuring vulnerable workers and communities are not left behind is one of the biggest challenges emerging economies will face in their energy transition. However, it also opens up new job opportunities and avenues for economic growth, states a new report released by the Institute for Energy Economics and Financial Analysis (IEEFA).

“Combining climate action with social equity can facilitate the energy transition in emerging markets and developing economies (EMDEs) without disrupting sectors that rely solely on fossil fuels,” says co-author Shantanu Srivastava, IEEFA’s research lead, sustainable finance and climate risk.

“A Just Transition aims to manage this change fairly by protecting affected workers and communities, creating opportunities for economic growth and ensuring the benefits of the transition are shared widely,” Srivastava notes.

While fossil fuel industries face the risk of stranded assets in an evolving energy landscape, large companies have the resources and access to capital to adapt. The greater risk for governments is that entire communities dependent on these operations will be left stranded by their closure.

The report emphasises the need for a “co-investment” approach for these asset closures, which combines financing energy transition assets like renewable energy with Just Transition activities, such as building community resilience or social support measures. These programmes often require concessional or grant-based finance.

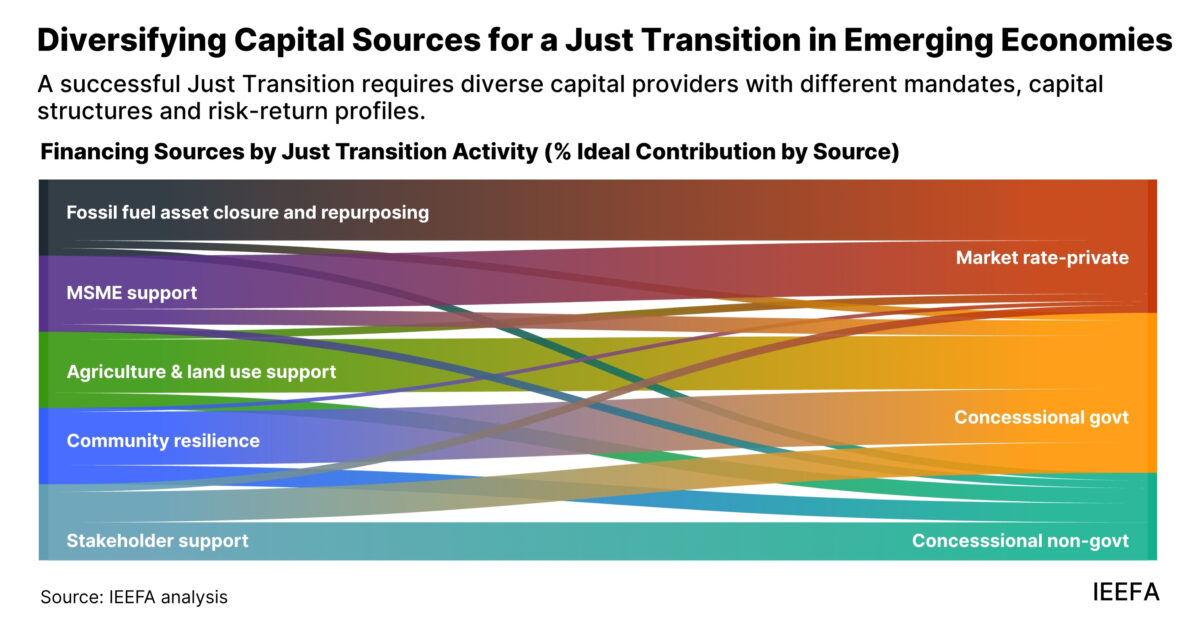

“Just Transition activities encompass a mix of hard energy transition assets, such as renewable energy, climate smart agriculture, and climate-resilient infrastructure, and ‘softer’ Just Transition aspects like responsible coal asset closures, stakeholder capacity building, labour reskilling, support for micro, small and medium enterprises (MSMEs), and community resilience,” says co-author Soni Tiwari, energy finance analyst at IEEFA.

The report draws on case studies from India, the Philippines, Ethiopia and South Africa to highlight how strategically planned, targeted and co-ordinated interventions can prepare vulnerable communities for a low-carbon future. It also highlights the pitfalls of inadequate planning and community consultation.

The Philippines’ Accelerating Coal Transition (ACT) investment plan shows how securing grant commitments early on to finance Just Transition aspects can help mobilise additional concessional and commercial capital to fund fossil fuel asset closure and repurposing.

South Africa’s Just Energy Transition Investment Plan (JET-IP) underscores the importance of institutional co-ordination, strong governance frameworks, and dedicated funding platforms that facilitate connections between funders and project developers.

In India, a targeted programme for MSMEs helped co-ordinate investment from domestic, multilateral and philanthropic institutions in policy reform, technical assistance and scalable clean energy solutions for MSMEs.

Another programme in India that has been hugely successful – the Zero-Budget Natural Farming (ZBNF) – has shown how targeted investments in capacity building can create a self-sustaining and low-carbon business model for farmers in vulnerable communities.

In Ethiopia, the United Nations Green Climate Fund (GCF) financed a rural water programme that illustrates the value of grant-based financing in fragile contexts, along with empowering local institutions to mainstream climate action and deliver on-the-ground results.

“With fiscal pressures mounting and fossil fuel revenues expected to decline, EMDE governments should look beyond their own budgets to a diverse set of capital providers, including multilateral development agencies, private investors, development banks and philanthropies,” Tiwari says.

“The financing challenge is not only about scale, but also about targeting suitable forms of capital for the right activities based on their risk-return profiles and developmental impact,” Srivastava emphasises.

By strengthening monitoring systems, aligning national schemes and fostering partnerships, EMDEs can access funding more easily and strive for a sustainable energy transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.