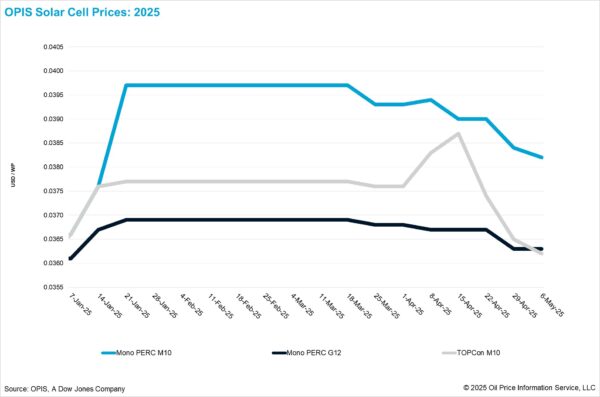

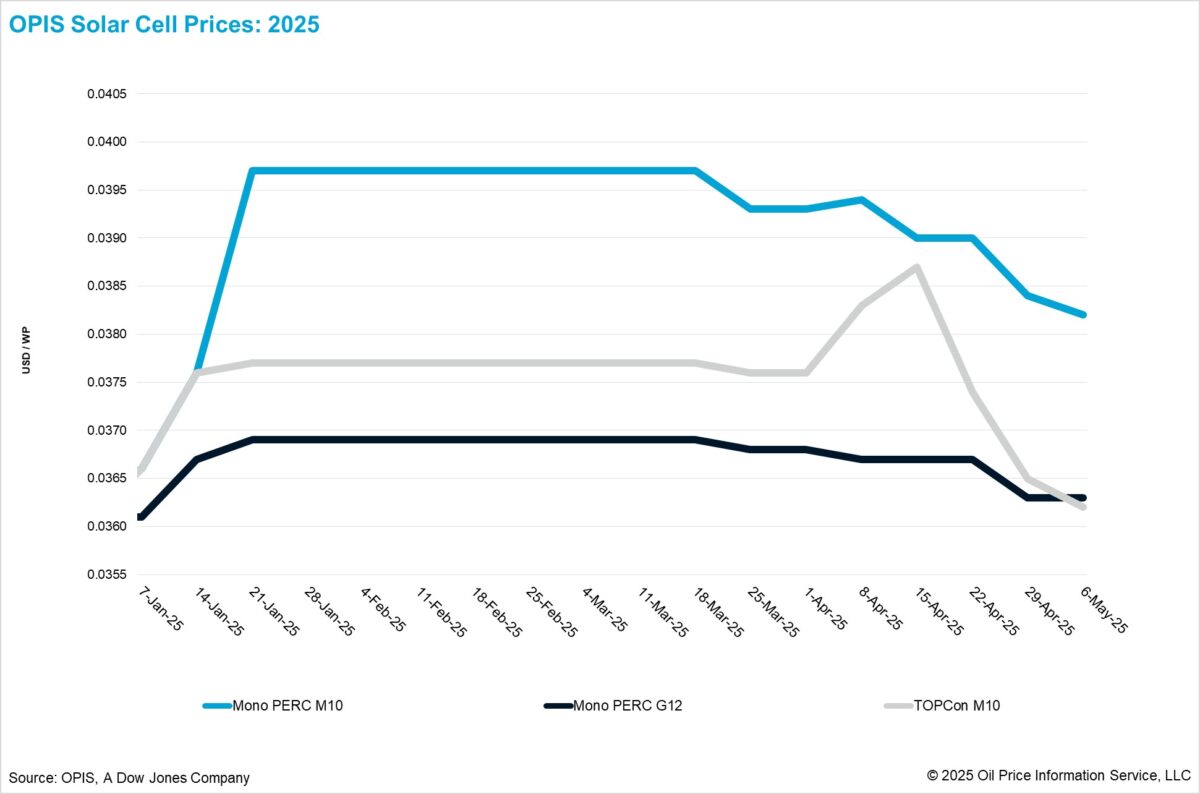

FOB China cell prices declined this week amid weaker market fundamentals, according to OPIS solar weekly report. TOPCon M10 cell prices fell 0.82% week on week to $0.0362/W, while Mono PERC M10 cells dropped 0.52% to $0.0382/W. Mono PERC G12 cell prices held steady at $0.0363/W.

Price indications for China domestic TOPCon M10 cell price averaged at CNY 0.282 ($0.039)/W, with indications between CNY 0.270/W and CNY 0.300/W. Domestic Mono PERC M10 cell prices were between CNY 0.290/W and CNY 0.310/W with an average of CNY 0.300/W, while mono PERC G12 prices averaged CNY 0.285/W, with a range of CNY 0.280/W to CNY 0.290/W.

TOPCon cell prices declined for the third consecutive week, weighed down by subdued end-user demand amid the implementation of the 430 policy in China and recent softness in both wafer and module prices. Industry sources expect end-user demand to stay subdued in the near term, following a period of front-loaded module installations over the past two months, during which Chinese cell production levels remained elevated.

According to an OPIS survey, Chinese cell production was high from March through April, with leading manufacturers operating at over 70% utilization, while second- and third-tier producers maintained levels around 50%. However, the outlook for May has deteriorated. Top-tier manufacturers are expected to reduce utilization rates to below 60%, while smaller players may drop below 30%. In line with these trends, sources report that projected production has been revised down from 64 GW in April to about 58 GW in May, with further cuts likely amid continued downstream weakness.

Looking ahead, industry sources suggest that pricing trends may begin to diverge across different N-type cell specifications. Chinese cell producers are reportedly shifting their focus toward promoting TOPCon 210R (182*210mm) cells, a move that could increase supply and exert additional downward pressure on prices for this specification.

Although OPIS has not yet begun assessing the FOB China price for these cells – owing to their limited adoption in overseas market – industry sources indicate that domestic production of this format has already captured over 30% market share in China. According to trade information, the mainstream domestic price for TOPCon 210R cells is approximately CNY 0.265/W as of this week, marking a notable decline from around CNY 0.310/W a month earlier.

In contrast, the supply of TOPCon M10 cells may tighten due to reduced production levels, suggesting that price declines for this specification could be more moderate in the near term.

Outside of China, in addition to the advancement of domestic cell manufacturing in the U.S., global cell manufacturing strategies are increasingly geared toward securing low- or tariff-free access to the U.S. market. Malaysia, Laos, and Indonesia have established themselves as key production hubs, with output also expected to grow in India and South Korea.

Additionally, Ethiopia has recently emerged as a new manufacturing site, while the Middle East is anticipated to develop into another notable production base starting in the second half of the year.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.