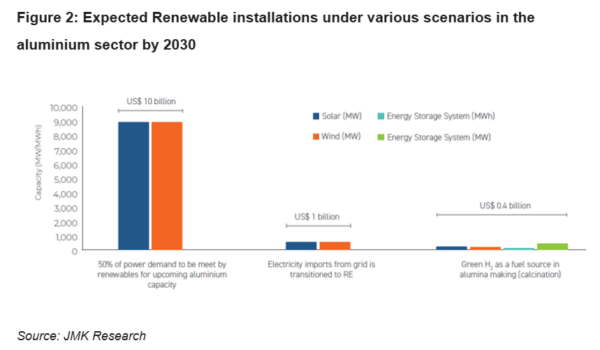

A new analysis by JMK Research says that with around 4.5 million tonnes per annum (MTPA) of new primary aluminium capacity expected by 2030, India’s aluminium sector could add up to 18-20 GW of renewable energy (RE) capacity, says a new report by JMK Research.

The report indicates that about 93% of this renewable energy capacity could be sourced to power upcoming aluminium smelting operations. An additional 6% would stem from transitioning existing grid electricity imports to renewable sources and 1% from early-stage efforts to replace fossil fuels with green hydrogen in alumina refining processes.

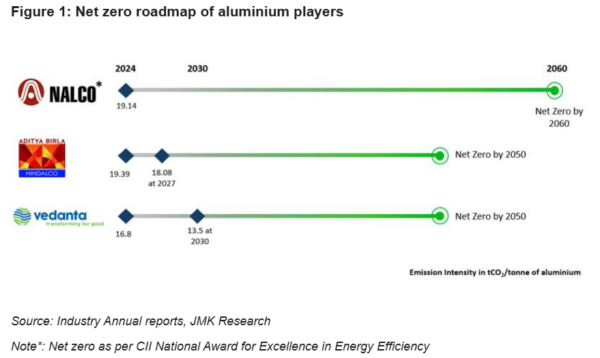

Aluminium demand is set to rise sharply as sectors like automobile and construction increasingly substitute steel with aluminium for its lightweight and corrosion-resistant properties. However, aluminium production is nearly four to five times more emission-intensive than steel on a per tonne basis, making it a focus area for industrial and climate action.

“The aluminium sector in India remains heavily reliant on captive coal-based power plants (CPPs) to meet its energy-intensive smelting demands, which typically require 14-15 MWh of electricity per tonne of aluminium. While decommissioning existing CPPs is not viable, the upcoming capacity expansions present a unique opportunity to adopt RE and reduce incremental emissions,” states the report.

Wind-solar hybrid systems and renewable energy integrated with battery storage present viable solutions to meet the sector’s round-the-clock power requirements. As battery storage costs continue to fall and sustainability gains momentum across the industry, these solutions offer scalable and increasingly cost-effective pathways for clean energy integration.

Challenges

The report states that the aluminum industry lacks a clear regulatory framework and targeted support mechanisms to guide its clean energy transition. This policy vacuum could hinder progress as global markets tighten sustainability standards. Instruments like the EU’s Carbon Border Adjustment Mechanism are already placing pressure on carbon-intensive exports, and without proactive measures, India risks losing.

In this context, the development of a sector-specific aluminium decarbonization policy, akin to the recently introduced green steel policy by the Ministry of Steel, is the need of the hour. Such a policy should offer a combination of regulatory clarity, financial incentives, and a technological roadmap tailored to the aluminium sector’s unique energy demands. This would enable large-scale renewable energy adoption and support the broader goal of positioning India as a global leader in green aluminium.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.